Tracking My 2020 Canadian Equity Portfolio

This year, I have designed a Canadian Equity Portfolio which has two goals: to beat its benchmark, the S&P/TSX Total Return Index, and have lower monthly volatility. I have been successfully following the same process for four years now as outlined in my Building a Bulletproof Portfolio posts (I, II, III, IV, and V). The portfolio is more diversified than the S&P/TSX Composite Index which is market capitalization weighted, and has a better mix of stocks with varying correlations which I believe is the reason for the superior performance over the years.

This year, in an effort to be as transparent as possible, I will be posting short weekly progress updates on my website which you can check out via this link. You can also read more about the portfolio by clicking on 2020 on my website’s navigation menu and download an Excel version for yourself. My goal is to encourage more people to move away from passive ETF’s or expensive mutual funds and create a greater sense of ownership by building their own diversified, defensive equity portfolios.

The start of the year was a good one, as the portfolio gained 2.39% vs. the iShares Core S&P/TSX Capped Composite Index ETF (Symbol: XIC) gain of 1.22% for a net outperformance of 1.17%. While trading fees need to be accounted for, the portfolio only has 30 stocks and is intended to be a buy-and-hold portfolio. Using a discount brokerage, you should be able to get your total fees less than the MER of even the lowest-cost ETF’s, plus gain the flexibility to change the structure of your portfolio as you see fit. It should also prove convenient at the end of the year when tax-minimization strategies such as tax-loss harvesting come into play.

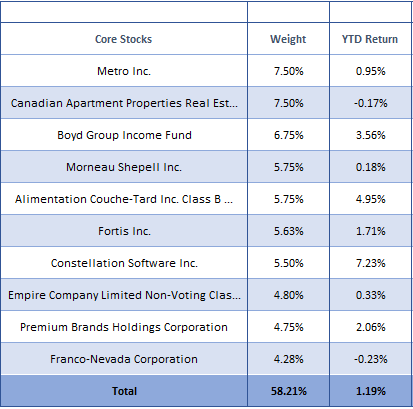

Here are the YTD results of the ten core stocks in my portfolio which make up about 58% of its weight. By clicking on this link, you can also track the progress of the mid-tier and speculative stocks in my portfolio.

As you can see, I favour defensive stocks such as Metro, Alimentation-Couche-Tard and Fortis but still leave room in my portfolio for growth securities such as the Boyd Group and Constellation Software. The key is balance rather than allocating the majority of my portfolio to Financials and Energy, as is representative of the S&P/TSX Composite Index and the ETF’s in which they track.

Thanks everyone for your support, and feel free to check back regularly to see the weekly progress!