The Case For Defensive Stocks

Introduction

I often get asked why I dedicate so much of my portfolio to defensive stocks as I have done again this year with my 2020 Canadian Equity Portfolio. One of the most common misconceptions is that while these stocks are less risky, they also have low returns and therefore, investors are better off investing in higher return stocks with higher volatilities. This idea of higher risk, higher reward seems to have been etched in our brains since we first started learning how to invest. It is also continually reinforced by risk questionnaires and assessments we take to slot us into appropriate risk categories which supposedly tell us which products to invest in.

I’m very much in favour of low-volatile stocks defensive sectors because in actuality, their returns are not as bad as you may think. While I do seek to disprove the notion that in order to achieve higher returns you have to take higher risks, it is only in the context of a pure equity portfolio like the linked one above. A balanced fund consisting of a sizeable portion of investment grade fixed income securities will of course have a lower risk factor than a pure equity portfolio. Understanding this difference in how we think of risk is crucial to developing the right portfolio mix.

Long-Term Historical Risk & Return

There are approximately 230 securities which make up the S&P/TSX Composite Index. Of those, 168 have a record trading back to January, 2008, so the monthly returns of these 168 securities up until November, 2019 will be my data set. Here are some basic statistics I calculated:

the average monthly return was 1.07%

the average standard deviation was 9.76%

the average return-risk ratio was 12.81%

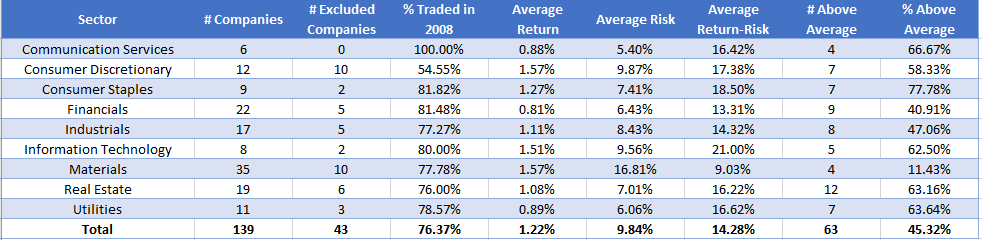

For now, let’s leave the benefits of diversification out of it and simply categorize stocks based on their return-risk ratio. Anything above 12.81% is favourable, while anything below 12.81% is unfavourable. By sector, here are the results, but you can look at it at an individual security level by downloading the source file.

The above table show the number of securities by sector as well as their average return-risk ratios. In addition, I have included the number of current S&P/TSX Composite Index securities which were not trading back in January, 2008. Below are a few notes I’ve made for each sector:

Communication Services

This sector looks quite attractive based on these metrics. All companies currently trading in the Index have been there since January, 2008, and all but one (Shaw Communications) have a return-risk ratio above the Composite average of 12.81%.

Consumer Discretionary

More than any other sector, the Consumer Discretionary sector has almost an even split of companies that have a long trading history and those which do not. Its average return-risk ratio is 17.38% which is good enough for third place among all sectors.

Consumer Staples

Nine out of 11 companies in the Consumer Staples sector have been trading since 2008 and roughly the same percentage have return-risk ratios above the overall average (the two which do not are Cott Corporation and Maple Leaf Foods). The average return-risk ratio for this sector is 18.50%, which may shock people as it’s the second best ratio behind the Information Technology sector.

Energy

Based on these metrics, there’s really nothing good to say about investing in this sector. Its average monthly return of 0.31% is the lowest out of all 11 sectors, its risk rank is in 7th place, and only 6 out of 28 companies analyzed have a return-risk ratio above the Composite average.

Financials

This sector is a heavily weighted one in mutual funds and ETF’s so we must pay special attention to it. The first thing that stands out to me is its very weak average monthly return of 0.81%. It makes up for it in part by having a very low monthly standard deviation of 6.43%, but the average return-risk ratio of 13.31% puts it in 9th place. The sector is luckily made up of companies with lengthy trading histories, but just over half of those have a return-risk ratio above the Composite average.

Health Care

This one isn’t really fit for analysis yet because it’s been taken over by cannabis stocks which obviously have little trading history. The one company with trading history back to 2008, Bausch Health Companies (formerly Valeant Pharmaceuticals) has been on quite a rollercoaster ride over the last decade. Let’s hope you were fortunate enough to sell back in 2015 because since then, its share price has depreciated by about 90%.

Industrials

A fairly stable sector, the metrics of the Industrials sector look an awful lot like the Financials sector. Its average risk and return are both good enough for 6th place, while the average return-risk ratio of 14.32% is a bit below the Composite average.

Information Technology

I’m not surprised to see the average return of this sector being one of the highest at 1.51%, but I am surprised to see its average risk of 9.56% near the Composite average of 9.76%. This is good enough to earn this sector the title of having the best return-risk ratio of 21%. It’s a shame this sector only constitutes 5.75% of the S&P/TSX Composite Index ETF (XIC).

Materials

Materials stocks, which are mostly made up of gold, silver and copper mining companies, have a pretty impressive average monthly return of 1.57%, but are also the most risky with its average monthly risk figure of 16.81%. Expect these stocks to swing a lot and maybe keep you up at night.

Real Estate

Real estate securities, which are mostly Real Estate Investment Trusts (REITs), have about the average Index monthly return but without the same risk. The average return-risk ratio of 16.22% fits right in the middle of the data set.

Utilities

While its average returns are not that impressive, only Communication Services has it beat on risk. The average return-risk ratio of 16.62% puts it in 4th place behind Consumer Discretionary, Consumer Staples and Information Technology.

Adjusting Out Energy and Health Care

If I’ve convinced you to largely stay away from the Energy and Health Care sectors, you may be interested in seeing what the above table looks like without the poor metrics of these 29 companies weighing down the data set.

As you can see, the average return-risk ratio jumps from 12.81% to 14.28%, making the bar a bit higher for the remaining stocks. All of a sudden, the Financials sector is less appealing, as its return-risk ratio of 13.31% is now below the average of the adjusted data set.

Incorporating Beta

Investopedia defines beta as: a measure of the volatility, or systematic risk, of an individual stock in comparison to the unsystematic risk of the entire market. In simple terms, it represents how an individual security will respond to swings in the market. A beta of -1 will react in the opposite direction of the market, while a beta of +1 will react the same as the market.

Understanding beta is important in the context of applying it to Modern Portfolio Theory. Investing in securities with varying betas (and ideally negative ones) can reduce the overall risk of the portfolio while still maintaining one’s desired return level. In other words, the return-risk ratio, which is very similar to the widely used Sharpe Ratio, can be improved by investing in these securities.

Using 5-year betas from TMX Money’s Stock Screener, I have calculated the average beta by sector for the securities in my data set.

And now we can see a clear winner when it comes to low beta’s which can reduce a portfolio’s risk: the Consumer Staples. Yet it only makes up 3.85% of the S&P/TSX Composite Index ETF linked above - in other words, nothing. Instead, 50% of the Index is made up of at market-performing (Financials) or risky and underperforming (Energy) stocks, while the real tools of diversification (Consumer Staples, Communication Services, Real Estate and Utilities) comprise just under 18% in total.

Summary

I would like to see investors consider making their portfolios more defensive in nature. As I hope I have convinced you by now, these defensive stocks have solid historical returns, low standard deviations, and low market betas. All three of these things combine to form a portfolio which not only will protect you during market downturns but still manage to keep pace when the market is booming. If you’re intent on using ETF’s, consider purchasing several sector ETF’s instead of a broad-based Index ETF. You’ll pay a little more in fees, but you’ll be so much more flexible in choosing the sectors you want to rather than the allocation being determined for you based on market capitalization.

Cheers!