Like High Dividend Stocks? Check This Out

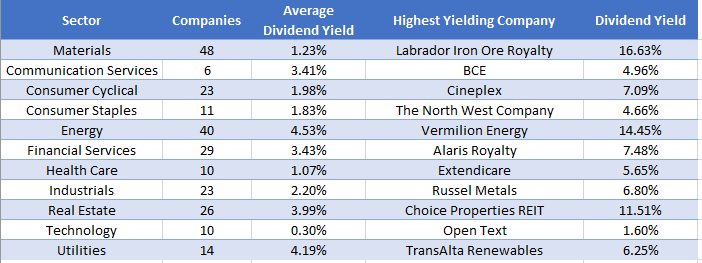

Many investors are attracted to high dividend-yielding companies. Assuming the company’s dividend is safe, it’s a good way to add regular income to your portfolio and possibly reinvest it as you see fit. Below are the top dividend-yielding companies for each major sector on the S&P/TSX Composite Index, as well as the sector’s average yield. Calculations are made using the January 3, 2020 closing price and assuming the most recent dividend will continue on for the next year.

You can see that some of these dividends do appear quite attractive, but when considering a dividend investment you must consider the obvious:

that the company will continue making dividend payments for your holding period

you are comfortable accepting the inherent risks of the stock and can endure temporary or permanent capital losses

Investors should therefore consider the total expected return of an investment rather than simply calculating dividend income by multiplying the yield by the investment. Take Cineplex, for example. The company was just acquired by the British theatre chain company Cineworld with the deal expecting to close sometime mid-2020. Shareholders at that time will receive $34 per share, which is why the stock has been trading pretty much at that level since the day the deal was announced on December 16, 2019. A dividend investor making a $10,000 investment, for example, in Cineplex right now based on the 7.09% yield above and assuming they will get $709 in annual income would be making an error for the following reasons:

the Board of Directors of Cineplex has to approve each dividend payment. There’s no indication that will continue to happen in light of the deal with Cineworld.

I assume Cineplex will be delisted when the deal closes as their operations will be consolidated and reflected in Cineworld’s stock (Symbol: CINE on the London Stock Exchange). After that, an investor will have to find a new investment.

Investors can’t just buy Cineplex at roughly $34 per share now and receive a 7% guaranteed annual dividend with no real risk of the share price changing until the deal closes. If that were the case, you might as well treat it as a government bond, which would be silly of course. The lesson here is that you must do your research to determine the likelihood of a dividend continuing and if it isn’t, you should keep looking.

The above list is a good starting point for any dividend investor, but certainly should not be taken as a recommendation to buy. Do your research, and make sure you’re fairly confident in the company’s plans over your holding period and are comfortable with the capital loss risks you’ll face with any equity investment.

Good luck!