Don't Overlook This Key Sector

We generally think of our investment decisions in terms of risk and return, and for most of us, we more or less believe that the greater the risk you take, the greater the possibility of your return. But a little bit of research introduces an interesting anomaly - with this one Canadian sector, long-term investors actually have achieved higher returns by taking less risk.

The sector I’m referring to is the often-forgotten Consumer Staples sector, representing a mere 3.85% of the S&P/TSX Composite Index. Today, this sector’s companies are dominated by grocery store chains such as Loblaw and Empire Company, parent of Sobeys, as well as discount store giant Dollarama and convenient store operator Alimentation Couche-Tard. It’s referred to as a defensive stock as it typically goes against the economic cycle - that is, when the economy is under-performing, these stocks continue to do well because they sell goods and services deemed essential to the average consumer. But as we will show you, they actually provide a decent return during positive economic times as well, and can act as great protection for your Canadian equity portfolio.

Most all investors understand what return is - simply put, it is a stock’s price changes plus any dividends earned less any fees paid. But risk is a little bit harder to understand. Risk can take many forms. It can be the odds of you losing your entire investment, the chances of it declining 10% in any given month, or even the odds that you can’t sell it when you want to. In finance, we try to combine all of these types of risk and standardize it into one number that will give you an idea how risky an investment is. One of the more common measures of risk is standard deviation, and this is what I’ll be referring to when I examine Canada’s Consumer Staples sector.

Standard deviation measures the extent of deviations from the average of a group of returns. Consider two stocks, both with an average annual return of 5%, but one stock’s returns are all over the map while another has fairly consistent returns - the first stock will have a much higher standard deviation and is therefore considered by most financial analysts to be a much riskier investment. With this framework, let’s analyze some of Canada’s key sectors using publicly available historical index information available on Investing.com from the period of January, 2000 until June, 2019.

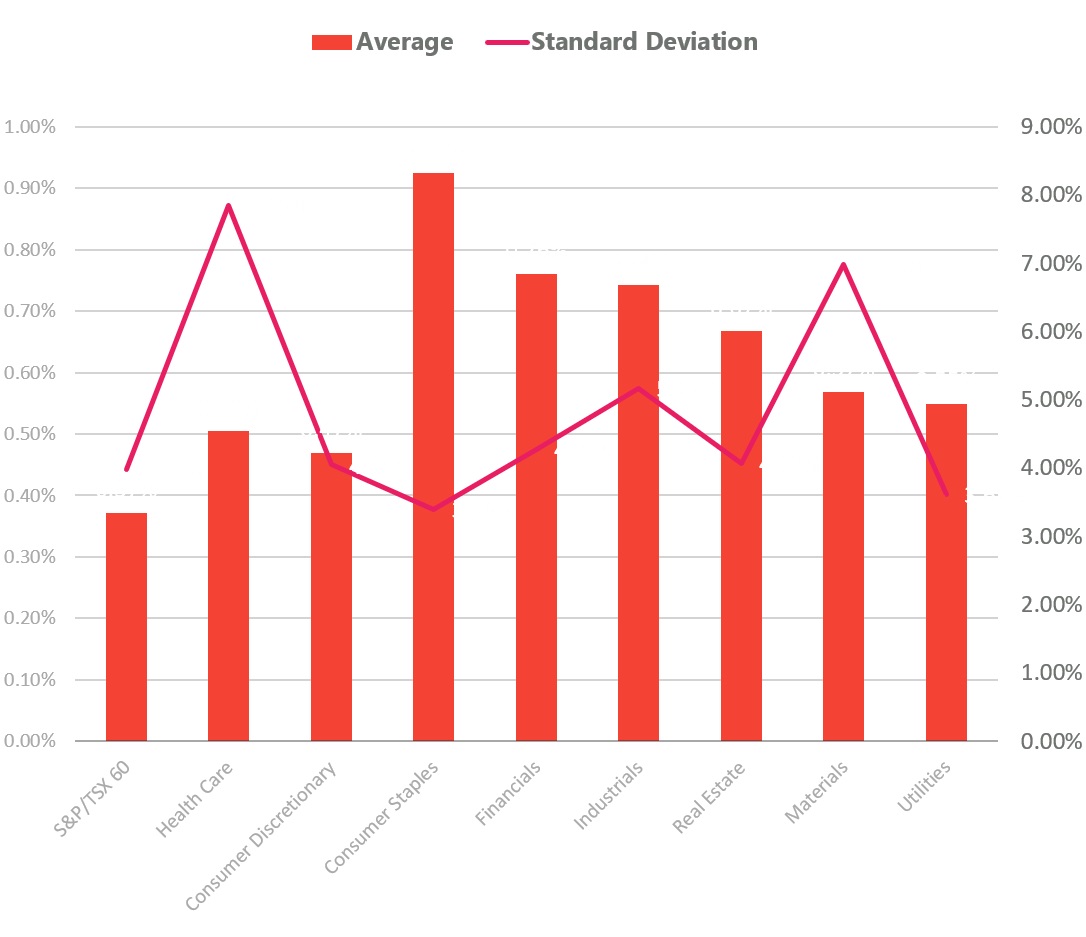

From this simple chart we can see something that is plainly obvious: risk and return are not really related at all. The riskiest sector, using standard deviation (the industry norm) as the measure of risk, is Health Care, with a standard deviation of 7.85%. But it also has an average monthly return of only 0.50%, the second lowest only to Consumer Discretionary at 0.47% (excluding the broad S&P/TSX 60 Index of course).

Consumer Staples, on the other hand, has both the lowest monthly standard deviation (3.39%) and the highest average monthly return (0.93%). Yet again, this sector only represents only 3.85% of the S&P/TSX Composite Index.

It makes sense that the S&P/TSX 60 Index has the lowest standard deviation of them all, as there are some obvious benefits of diversification once you include stocks from all sectors. But investors in such indexes are really getting shortchanged on the return side, averaging only 0.37% per month. As not only a do-it-yourself investor, but any investor really, you should make sure you are being compensated properly for taking on additional risk. If you discover you aren’t, it may be worth your time researching a better alternative or, if you are working with a financial advisor, seek his or her expertise.